NYC-202 - Unincorporated Business Tax Return (for Individuals, Single-Member LLCs)ĭownload Unincorporated Business Tax Worksheet - You must attach this worksheet to amended returns reporting changes or corrections to taxable income or other bases of tax by the IRS or New York State DTF. NYC-114.12 - Claim for Beer Production Credit for Unincorporated Business Taxpayers. NYC-114.8 - Lower Manhattan Relocation Employment Assistance Program (LMREAP) Credit Applied to Unincorporated Business Tax. NYC-114.7 - UBT Paid Credit For Unincorporated Business Taxpayers.

NYC-202 - Unincorporated Business Tax Return (for Individuals, Single-Member LLCs)ĭownload Unincorporated Business Tax Worksheet - You must attach this worksheet to amended returns reporting changes or corrections to taxable income or other bases of tax by the IRS or New York State DTF. NYC-114.12 - Claim for Beer Production Credit for Unincorporated Business Taxpayers. NYC-114.8 - Lower Manhattan Relocation Employment Assistance Program (LMREAP) Credit Applied to Unincorporated Business Tax. NYC-114.7 - UBT Paid Credit For Unincorporated Business Taxpayers.

Inst 1040 (Schedule B) Instructions for Schedule B (Form 1040 or Form 1040-SR), Interest and. Inst 1040 (Schedule A) Instructions for Schedule A (Form 1040 or Form 1040-SR), Itemized Deductions.

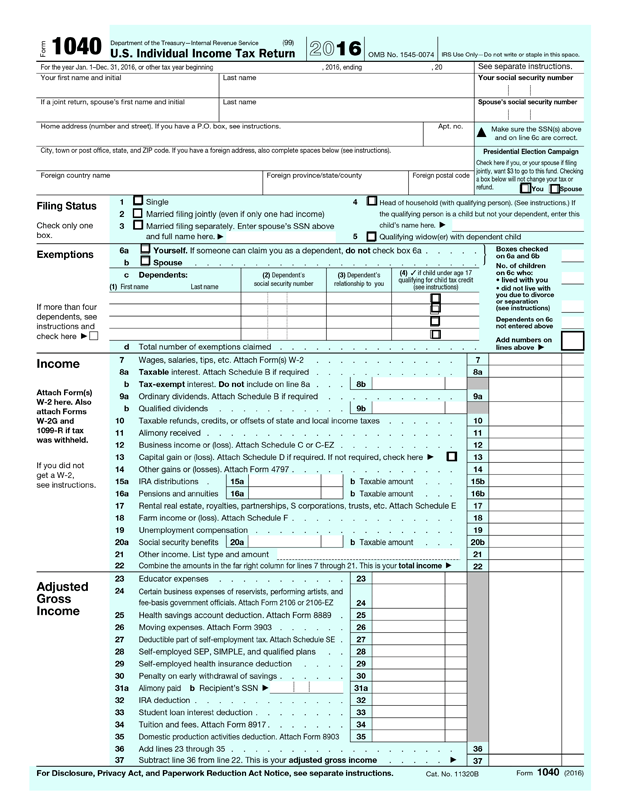

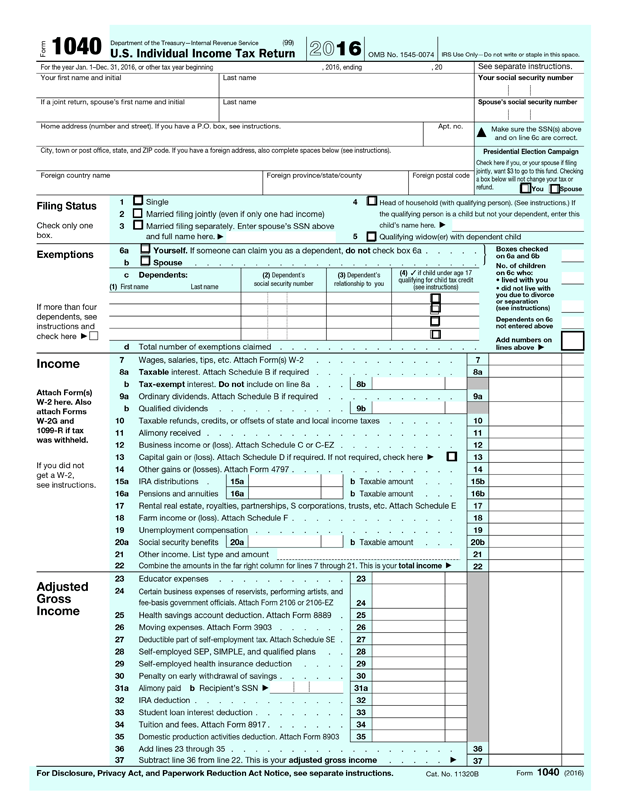

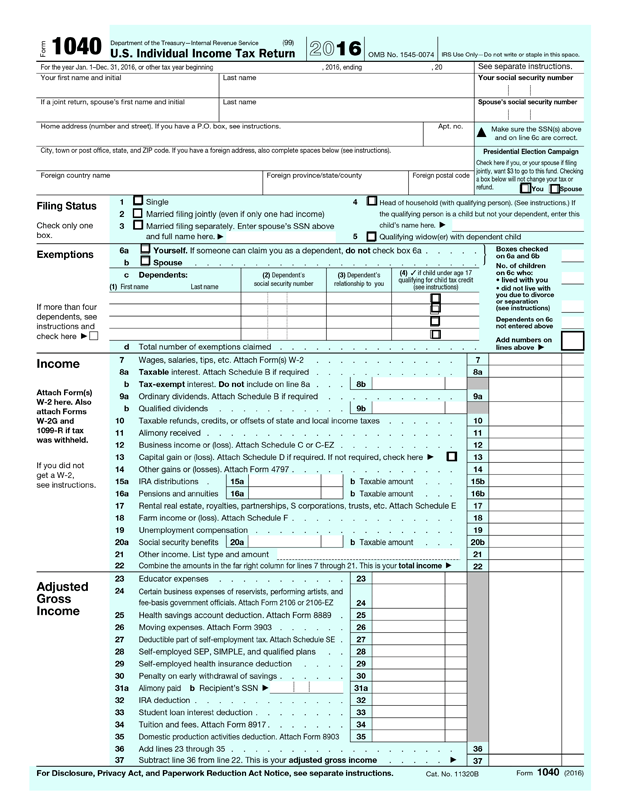

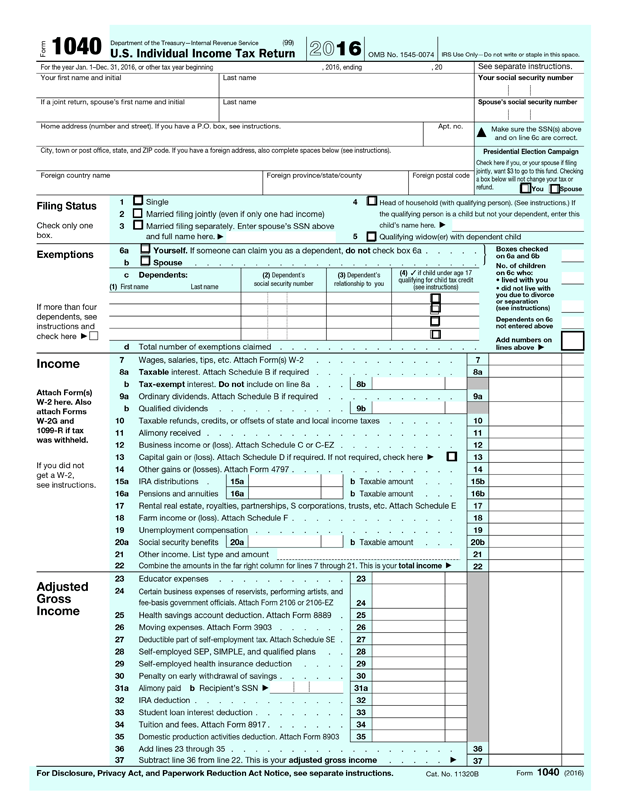

NYC-114.6 - Claim for Credit Applied to Unincorporated Business Tax Instructions for Form 1040 Schedule 8812, Credits for Qualifying Children and Other Dependents (Spanish Version) 2022. NYC-114.5 - REAP Credit Applied to Unincorporated Business Tax. NYC-5UBTI for 2023 - Declaration of Estimated Unincorporated Business Tax (for Individuals, Estates, and Trusts).  NYC-5UB for 2023 - Partnership Declaration of Estimated Unincorporated Business Tax. NYC-NOLD-UBTP - Net Operating Loss Deduction Computation (for Partnerships including Limited Liability Companies). NYC-NOLD-UBTI - Net Operating Loss Deduction Computation (for Individuals, Single-Member LLCs, Estates and Trusts). NYC-EXT - Application for Automatic Extension of Time to File Business Income Tax Returns. For details on these and other changes see What's New in these instructions.Current Unincorporated Business Tax (UBT) Forms 2022 Unincorporated Business Tax (UBT)ĭocuments on this page are provided in pdf format. ? The overall limit on itemized deductions has been eliminated. ? The deduction for miscellaneous expenses has been eliminated. ? The deduction for state and local taxes has been limited. ? A new tax credit of up to $500 may be available for each dependent who doesn't qualify for the child tax credit. ? The child tax credit amount has been increased up to $2,000. Forms 1040A and 1040EZ will no longer be used. Book excerpt: ? Form 1040 has been redesigned.

NYC-5UB for 2023 - Partnership Declaration of Estimated Unincorporated Business Tax. NYC-NOLD-UBTP - Net Operating Loss Deduction Computation (for Partnerships including Limited Liability Companies). NYC-NOLD-UBTI - Net Operating Loss Deduction Computation (for Individuals, Single-Member LLCs, Estates and Trusts). NYC-EXT - Application for Automatic Extension of Time to File Business Income Tax Returns. For details on these and other changes see What's New in these instructions.Current Unincorporated Business Tax (UBT) Forms 2022 Unincorporated Business Tax (UBT)ĭocuments on this page are provided in pdf format. ? The overall limit on itemized deductions has been eliminated. ? The deduction for miscellaneous expenses has been eliminated. ? The deduction for state and local taxes has been limited. ? A new tax credit of up to $500 may be available for each dependent who doesn't qualify for the child tax credit. ? The child tax credit amount has been increased up to $2,000. Forms 1040A and 1040EZ will no longer be used. Book excerpt: ? Form 1040 has been redesigned.

This book was released on with total page 120 pages. Book Synopsis IRS Form 1040 Instructions - Tax year 2018 (Form 1040 included) by : Internal Revenue Service (IRS)ĭownload or read book IRS Form 1040 Instructions - Tax year 2018 (Form 1040 included) written by Internal Revenue Service (IRS) and published by.

0 kommentar(er)

0 kommentar(er)